Does your insurance cover floods? Given the awful situation that’s been unfolding in Southern Alberta in the last 24 hours, this is a popular question. Most of our PROtique Masterplan policies includes it as standard coverage, and those that don’t would have offered it as an optional coverage to add to your policy for a nominal amount. The PROtique Masterplan policy also covers sewer backup, which usually happens when there’s a flood.

What’s the difference between a flood and a sewer backup? In insurance, a flood is typically considered to be either when a body of water overflows, or when there is overland flow of surface water from a lot of rain. A sewer backup is when sewage backs up through your drains and enters your premises. It’s a little too early to tell how insurance companies will treat the situation – will it be treated as a flood, a sewer backup, or both. Why is it important? Because it will determine what your deductible will be.

The purpose of insurance is to spread risk amongst many policyholders. But flooding is a risk for only a small percentage of the population – that is, those who have businesses in a flood plain or close to rivers or lakes. Since most businesses are not exposed to the risk, most businesses don’t buy flood coverage. Because of this, flood coverage usually has pretty high deductible. It’s not unusual to have a $50,000 deductible for floods. We’ve managed to have the PROtique Masterplan deductible reduced to $25,000, and it can be difficult to find an insurance company willing to offer a deductible that’s any lower. There simply aren’t many options for buying flood coverage for your business. On the other hand, the sewer backup deductible on the PROtique Masterplan policy ranges from $2,500 to $5,000.

Unfortunately, overland flooding is not covered by home insurance policies anywhere in Canada, although homeowners can usually buy sewer backup coverage.

If you have a flood or sewer backup claim, and you have business interruption coverage like what is on the PROtique Masterplan, then there will also be coverage for the loss of profits and to pay any necessary ongoing expenses (like your salary) while your closed.

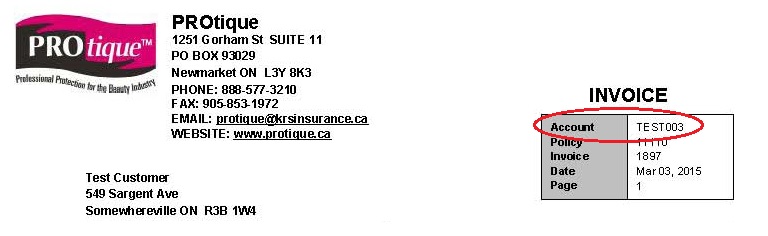

In a disaster like we’re seeing in Alberta, the first priority is to ensure your safety. Dealing with the loss or damage of property will happen soon enough. If you have a PROtique Masterplan policy and need to make a claim, once you’re safe, please call our office at 1-888-577-3210. Most PROtique policies are insured with Intact Insurance, and they typically send a disaster response team to the affected areas to help customers deal with their claims. At this time we do not know what their response time will be, but will update this post as soon as we have more information.